The richest investor & third richest person in the world, Mr. Warren Buffet, quotes “Someone’s sitting in the shade today because someone planted a tree a long time ago.” And so, even he did not become the richest person in a day. He started his investment at the very age of 11 years, and many a times found quoting as that he started a bit late, otherwise he would have become richest person earlier. Today he has assets valued for more than $ 50 Billion. He says “in this world there are two ways to earn income; one is to exchange you labor for dollars and the other is to have your money earn money for you.” And this process of money working for you is the phenomenon of INVESTMENT.

(This comparison is based on my personal experience and the information available on various concerned websites.)

SAVINGS & INVESTMENT

Before we understand investment, it is important to understand savings. Savings are the unspent incomes, or deferred expenditures. A simple formula to calculate savings is:

INCOME – EXPENDITURE = SAVINGS

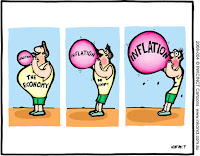

Now an individual can keep such amount saved, with himself in his pocket or a piggy bank. But there are few issues when he is doing this as, firstly it may be stolen or lost & secondly due to inflation it looses its value, as it is kept idle. And for these reasons these savings should be invested.

We can define investment as the process of, ‘Sacrificing something now for the prospect of gaining something later’. Some examples of investment:

- A government employee opens a deposit account with post office.

- A person buys the shares of Tata Motors.

- A farmer buys a land for farming.

- A cricket fan bets on a cricket match.(surprised?? For details: patnisaurabh@gmail.com)

This question is often asked by the people, why should they invest??? Investments are both important and useful in the context of present day conditions. Here are some factors to answer it.

- Income: In the last two decades, our economy has witnessed a consistent growth. Due to which the overall demand for all the resources, including human has increased. And this demand has come with the rise in salaries, perks and other benefits. And more the income more would be the demand for investment, in order to bring in more income above their regular income.

- Inflation: As discussed above if an individual, keeps the savings in his pockets, the inflation tends to erode the value of such savings, as the time passes by. And to be paced with the inflation, the investments have to be made by the individual, to cover such a decline in the value due to inflation.

- Taxation: The government, in lieu for encouraging the savings in the economy, tends to provide various tax exemption opportunities for making an investment into selective avenues. And if the individual happens to invest in it, he tends to save some tax liabilities.

- Interest Rates: To take the advantage of the rising interest rates and trying to generate more income.

- Future goals: To achieve ones future goals like, children’s higher education, buying a house etc, smoothly proper and regular investments are necessary.

- Risk & Return: To take a calculative risk in order to generate that extra mile of returns.

Now as we know that there are many different types of investment options are available, like shares, debentures etc. It is very important to make an appropriate choice, as per ones requirement. The selection of an investment option by an individual would be based on certain criteria, let us first discuss those criteria or factors that could influence such a selection.

- Returns: This is the main factor that influences the selection of an investment option. Everybody would try to select an investment which provides the highest possible returns. Returns are the monetary benefit, which an investment option generates over the amount of money invested in it. The returns in general are measured in percentage. An investment can generate basically two forms of returns, categorized as:

- Incomes: This is the return, which an investment generates at a regular interval. This type of return is generally has a fixed rate. Example for such type of returns can be dividends and interest.

- Capital Gains: This is an increase in the value of an investment that gives it a higher worth than the purchase price. The gain is not realized until the asset is sold. A capital gain does not correspond to a particular time interval. It gets affected by many factors like the performance of the asset, demand and supply for the same etc. A capital loss is incurred when there is a decrease in the capital asset value compared to an asset's purchase price.

- Risk: Traditionally risk is viewed as something ‘negative’. "Risk is the chance that an investment's actual return will be different than expected". This includes the possibility of losing some or all of the original investment. This is a very important factor which will influence the selection of an investment option. If an individual aspire for higher returns from an investment, then generally he has to take a higher amount of risk.

- Liquidity: The degree to which an asset or security can be bought or sold in the market without affecting the asset's price. Liquidity is characterized by a high level of trading activity. And higher the liquidity of an asset, easier it is possible to buy or sell the asset at the desired price and quantity.

- Lock in Period: It is the period during which an asset cannot be sold or redeemed earlier than scheduled date, without incurring penalties.

- Tax Benefits: The Income Tax Act of India provides tax rebates for the investment into certain assets, varying for different options.

- Convenience of owning: It is one factor, which analyzes how easy it is for an individual to gain the access to the investment option for buying and selling of the same.

(This comparison is based on my personal experience and the information available on various concerned websites.)

Thus investment and that to right investment is necessary for every person dreams of becoming rich, and lotteries, slot machines, betting, etc will not make it happen. Truth is, every time you waste your money on the lotteries, you put yourself farther and farther, from financial success. Every penny you waste on it, makes you poorer, and someone else richer. Thus, a prudent investor will always stick to the basics and will reap the benefits of his investment for a very long time.

WISH ALL MY READERS HAPPY INVESTING!!!!!!!!!!!!!